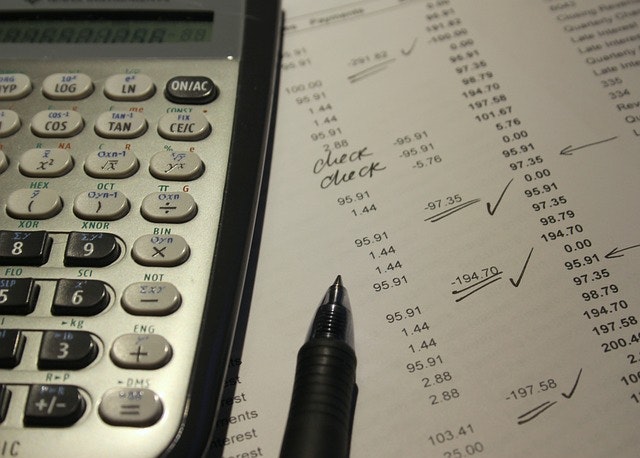

The end of tax season might feel like a distant memory, a complex puzzle finally solved. But staying proactive now can help avoid headaches when the tax cycle rolls around again. Both individuals and businesses can benefit from a few strategic steps to stay organized and ahead of potential stress. This blog will guide you through essential reminders focused on those who have already filed, those who filed an extension, and those making quarterly payments.

For Those Making Quarterly Payments

If you're making quarterly payments, mark your calendars with the upcoming due dates: April 15, June 16, September 15, and January 15. Sticking to these dates can prevent penalties and keep your finances on track. Consider setting up calendar reminders or automating payments to ease this process.

For Those Who Filed an Extension

If you've filed for an extension, it's crucial to note the upcoming deadlines: October 15, 2025, for individuals and C corporations, and September 15, 2025, for S corporations and partnerships. Starting your preparation early can mitigate the stress of last-minute scrambles and ensure that everything is in order by the time your deadline arrives.

For Those Who Have Already Filed

Even if you've already filed, the work isn't entirely done. Take some time to review your tax return for any discrepancies and make sure you securely store all supporting documents. An organized collection of these documents will be invaluable when the next tax season approaches, significantly simplifying the process.

In conclusion, a bit of organization and proactive management can go a long way post-tax season. Take these small steps now to pave the way for a seamless and stress-free experience next year.